Cash credit is a facility to withdraw money from a current bank account without having credit balance but limited to the extent of borrowing limit, which is fixed by the commercial bank. The interest in this facility is not charged on the borrowing limit, which is given by the bank but on the daily closing balance. We are explaining the calculation of interest in the latter part of this article using an example.

CC is a very common facility by banks. It is one of the essential short term sources of finance for a business. The availability is also not very difficult.

Borrowing limit, in the cash credit facility, is a limit on the maximum amount of borrowing specified by the bank. Till this limit is not exhausted, the borrower can withdraw and deposit funds any no. of times. The bank determines the borrowing limit based on the drawing power of the borrower. Banks evaluate drawing power by analyzing book debts, inventories, and creditors etc. For a detailed knowledge about what drawing power is and how banks calculate cash credit limit? You can read our detailed post on Drawing Power.

This is one unique feature of CC Account. Unlike other types of debt financing products of banks like loans, the interest here is charged on the daily closing balance of the cash credit current account and not on the sanctioned amount. It is an incredible motivation for the borrower to collect money from the debtors as soon as possible and deposit in the current account. Depositing money back to this account will save the entrepreneur a lot on interest costs. It is as good as investing the surplus funds instantaneously at the interest rate, which he pays on the cash credit limit. We have given a detailed explanation of interest calculation with the example later in the post.

Typically, a bank would levy charges in the situation when the borrower is not using the cash credit account. It’s undeniable from the bank’s point of view as it is blocking some amount of its ‘float’ for the borrower.

For example, in a 1 million cash credit limit, 0.5 million may be the average monthly minimum usage level. If the borrower is using the limit below that, say, 0.35 million, the bank will levy some charges on the unutilized portion i.e., 0.15 million (.5 – .35). The charges may range between 0.5% to 2% depending on the policy of the bank/financial institution. For an illustration, if the charges are 1%, it would be 1% of 0.15 million = 0.0015 million ~ $1,500.

A cash credit facility is extended against security. Securities may be in the form of stock, debtors, etc. as primary security and fixed assets and other immovable properties, etc. as collateral security.

The limit allowed is valid for one year, and then the drawing power will be re-evaluated. One year is just an example, whereas in some cases, it may be evaluated every quarter. This would vary from case to case and also depends on the policies of the various institutions.

A lot of loan defaults happen globally. Hence, banks have created stringent rules for providing cash credit facility to a company. After studying a company’s books of accounts and income-tax filings of the promoters, a bank will decide on the amount to sanction. It may range anywhere between 50%-75% of the collateral offered as security. This percentage may change based on the company’s books of accounts and the amount needed. A bank uses its infrastructure in terms of the time and energy of its employees, software, business visits, etc. to evaluate a limit. Therefore it expects the borrower to utilize the facility for a minimum period say it is one year. If a borrower for any reason decides to close this facility before that, the bank may levy some prepayment charges.

Cash credit is shown in current liabilities under the sub-head “Short Term Loans” in the balance sheet for accounting purposes. The bank providing the cash credit facility opens a current account in the company’s name. Journal and ledger entries are similar to those made for transactions in other bank accounts. But there is a significant difference between the cash credit account and other bank accounts. A cash credit account will always have a credit balance – denoted as “Cr.” balance. Whereas other regular bank accounts always have a debit balance- denoted as “Dr.” balance.

XYZ Pvt.Ltd is a furniture manufacturing company. The manufacturing process is lengthy, involving both machinery and manual workforce. It takes about 25-30 days’ time period for a product’s manufacturing process to start until it reaches the showrooms for sales. Also, they have to maintain a significant inventory of raw materials to finished goods. Because of the long turnaround time, they feel the requirement of additional working capital to increase production and sales.

They approach ABC Bank to extend them cash credit to the tune of $1 million to meet their short-term financing needs. The bank evaluates the drawing power of the company by studying their detailed income and expenditure statements, balance sheets, and income-tax filings of the last 3-4 years.

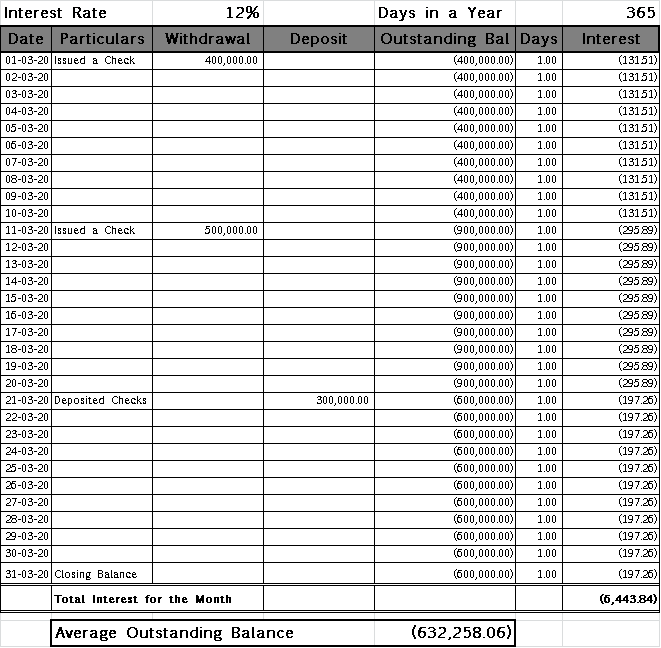

For example, assume following simple transaction from the CC account of XYZ Pvt Ltd, whose interest rate is 12%, and borrowing / sanctioned limit is 1,000,000.

| Date | Particulars | Withdrawal | Deposit | Outstanding Balance |

| 01-03-20 | Issued Checks | 400,000.00 | (400,000.00) | |

| 11-03-20 | Issued a Checks | 500,000.00 | (900,000.00) | |

| 21-03-20 | Deposited Checks | 300,000.00 | (600,000.00) | |

| 31-03-20 | Closing Balance | (600,000.00) | ||

| Total | 900,000.00 | 300,000.00 |

Now we see that the first outstanding balance is -400,000. As per the dates mentioned, the borrower used this amount of money into his business for 10 days and similarly, -900,000 for 10 days and -600,000 for 11 days.

Average Outstanding Balance for this account for March having 31 days will be calculated as follows:

= (-400000*10 + -900000*10 + -600000*11) / 31 = 632,258.06

Therefore, interest for this month will be calculated as follows:

Average Outstanding Balance * Interest Rate * No. of Days in the Month / No. of Days in the Year

=632,258.06*12%*31/365 = 6443.84

Alternatively, it can also be calculated after the completion of each day with the same formula. Just need to replace days of the month with the number of days a particular balance is used for.

-400000*12%*10/365 = 1315.08

-900000*12%*10/365 = 2958.90

-600000*12%*11/365 = 2169.86

Total = 1315.08 + 2958.90 + 2169.86 = 6443.84

The answer will be the same. The concept is to calculate interest on the daily closing balance. You can also look at it following manner for a perfect understanding. We have taken fewer transactions for the sake of simplification.

The most important benefit of cash credit is its flexibility of deposit and withdrawals. Due to this, a borrower can save a lot of interest costs by depositing the extra cash available with him. It also keeps the borrower motivated towards collection from debtors, which will not only expedite the cash cycle but also bring a disciplinary effect on the debtors and borrower himself.

The primary disadvantage is that securities required should be adequate, and the adequacy is evaluated time and again, which increases administrative work for the business.